child tax credit 2021 dates by mail

You can check eligibility requirements for stimulus. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

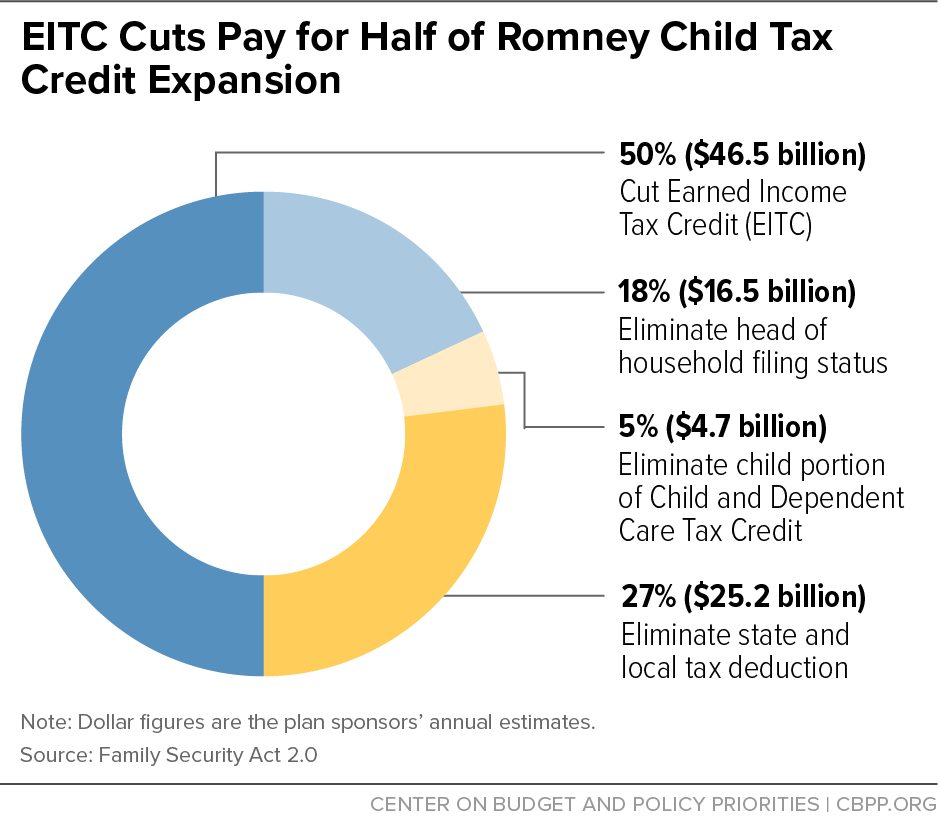

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly.

. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. 1200 in April 2020. 1400 in March 2021.

CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. Staples Provides Custom Solutions to Help Organizations Achieve their Goals. 600 in December 2020January 2021.

These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. Get your advance payments total and number of qualifying children in your online account.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The payment for children. Your amount changes based on the age of your children. Shop Save Today.

Have been a US. 31 2021 so a 5-year. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

New 2021 Child Tax Credit and advance payment details. We dont make judgments or prescribe specific policies. Enter your information on Schedule 8812 Form.

The new advance Child Tax Credit is based on your previously filed tax return. These payments will generally equal 300 per month for each child age 5 and. If you havent been getting child tax credit.

See what makes us different. But many parents want to know when. To reconcile advance payments on your 2021 return.

Ad File a free federal return now to claim your child tax credit. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Regular mail through the post office.

By August 2 for the August. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The IRS bases your childs eligibility on their age on Dec. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Ad Discover a Wide Selection of Tax Forms at Staples. October 14 2021 459 PM CBS Chicago. The law requires nearly half of the credit to be sent in advance which is why the IRS is sending out monthly payments from July 2021 to December 2021.

Child Tax Credit amounts will be different for each family. Families with qualifying children will receive 3000 for each child age 6 to 17 and 3600 for each child under 6. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300 monthly payments this year.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Childctc The Child Tax Credit The White House

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Tax Credit Definition How To Claim It

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Parents Guide To The Child Tax Credit Nextadvisor With Time

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

2021 Child Tax Credit Advanced Payment Option Tas

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Missing A Child Tax Credit Payment Here S How To Track It Cnet